Robin Roberts reports on current trends in researching and buying cars on-line.

Ford is streets ahead of rivals on-line, that’s the conclusion of a marketing study by Mediaworks…

The analysis by Mediaworks looks at the success of selling brands on the web and it contains a few surprises.

Coming after two other reports had showed that younger buyers are most influenced by advertising, and also that savvy-buyers are now beginning their on-line searches for replacement cars up to four months before they buy, the Mediaworks study is a vital piece of work for dealers and manufacturers thinking about September-plate changes.

After a boom in March to beat new tax and BIK changes in April, they have seen the brakes going on sales in April and the SMMT car makers’ body has warned it does not see much of a lift until the new September prefix.

Mounting concern in cities about possible diesel tax charges and an investigation by the Financial Conduct Authority into credit agreements and Personal Contract Purchase (PCP) arrangements is also beginning to be felt on forecourts.

Some dealers have been contacting existing customers, offering them special deals to trade in early so the businesses can hit increasingly higher sales targets and they can shift pre-bought stock from the car makers. Sometimes these are models which have been registered already to make those targets in February and March. These are, however, effectively second-hand cars and would be normally discounted anyway.

While the Mediaworks report does not include Vauxhall, PSA and FCA, it does cover a number of other brands and close analysis shows up those doing well and where improvements could be made.

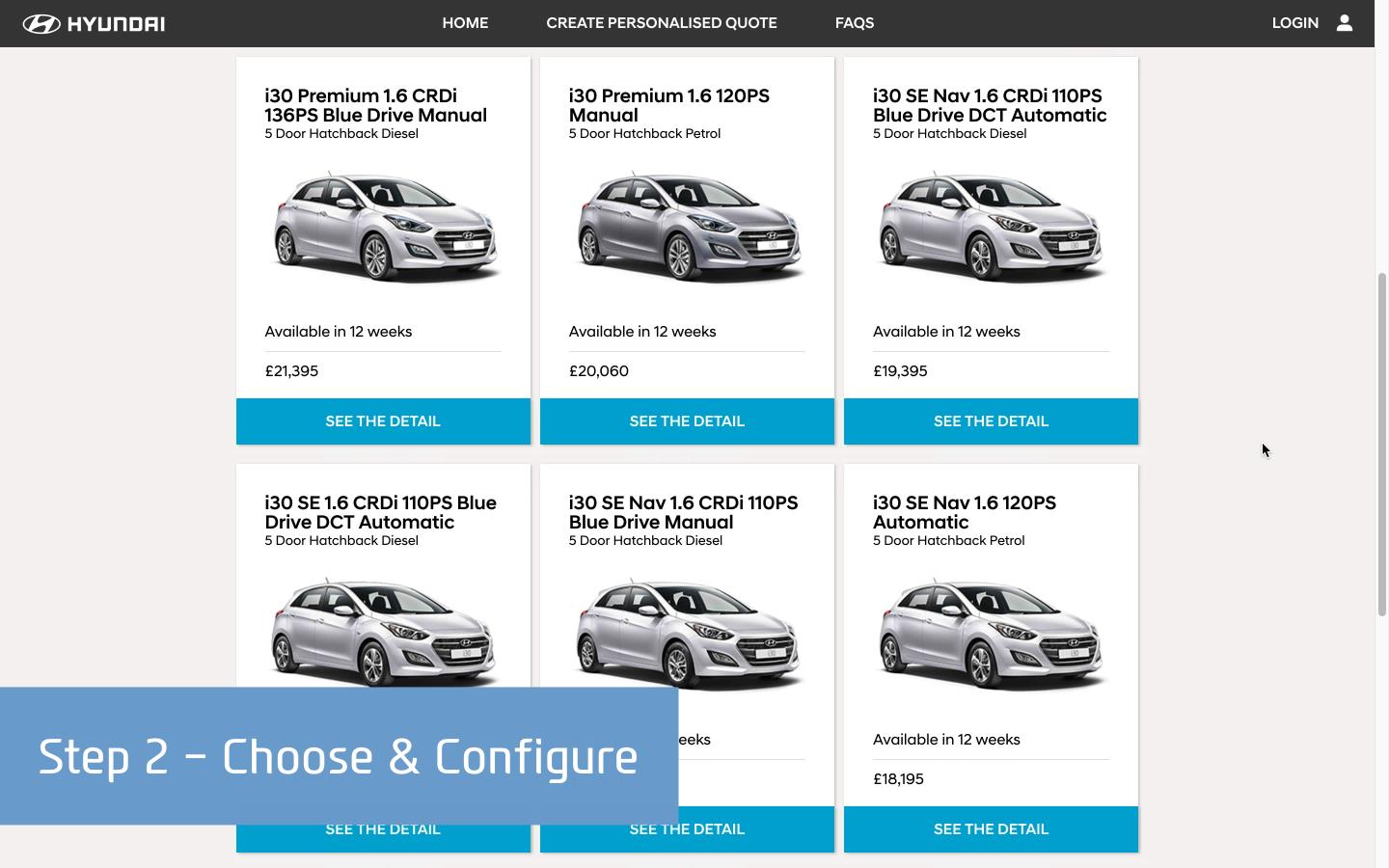

Their white paper describes improving new and used sales after the recession and the growing reliance and importance of online ownership experiences, but only two manufacturers offer a fully-digital delivery for Hyundai and BMW models (see images), and there is immense room for growth.

They highlight the fact that 97% of new car buyers now thoroughly research options online before visiting a showroom.

Two-thirds of online research lasts eight hours in all, but nearly 40% will begin looking four months in advance, making now the time they visit in the virtual showroom for August ordering and September delivery. In the surfing selection a typical buyer may make 900 digital actions for words, images, searches, reviews, recommendations, videos and dealerships or manufacturers.

Mediaworks has done the same for car rental companies, breakdown cover, tyres, repairs and event GPS manufacturing, but it’s the car-makers’ survey which is likely to be of most interest.

The study shows that some manufacturers have raised their online presence in six months while others have reduced and there is room for others to improve still further.

The click-to-car champions are in order of success: Ford, Volkswagen, Audi, BMW, Mercedes-Benz, Toyota, Land Rover, Jaguar, Volvo, MINI, Alfa Romeo and Lexus.